Revenue and gross margin

Revenue recognition is an

accounting principle which defines when and how a business’s revenue should be

recognised, it also defines the accounting period to which a business’s revenue

and expenses should be recorded. The principle behind revenue recognition can

be summed up as – A company will recognise revenue to show the transfer of

good or services to the customer for an amount that reflects the consideration

to which it believes itself to be entitled and the collection of such

consideration is reasonably assured. This has been explained in the

five-step model of revenue recognition.

The Five-step model

1. Identifying of Contract

2. Identifying performance

obligations

3. Determine transaction price

4. Allocate transaction price

5. Satisfaction of performance

obligation (Recognition of revenue)

The standard for revenue

recognition per IFRS 15, ASC 606 and Ind AS 115 are pretty much similar in

their scope and application except for a few differences.

Click here for the Five step model for

revenue recognition.

Some terms to know:

1. Principal

vs Agent – Principal controls the goods and services. Agent arranges

for other parties to provide the goods or services. The entity is an agent if:

a. Another

party is responsible to satisfy the performance obligation

b. They

are paid a fee or commission

c. Does

not control pricing

d. No

inventory risks

e. Not

exposed to credit risk

2. Repurchase

agreements – a contract where an entity sells an item and also has the

right or option to buy-back.

a. If it

can or has to repurchase the sold item for less than the original sale value

it’s classified as a lease.

b. If the

repurchase price is equal to or greater than the original sale price its

classified as a financing arrangement.

i. The

entity must continue to recognise the asset

ii. Recognise

a financial liability for consideration received from customer

iii. Recognise

difference between consideration received and to be paid as interest expense

3. Bill

and hold arrangement – is a contract in which the entity bills the

customer for a product that it still hasn’t delivered to the customer. Revenue

cannot be recognised until the customer has obtained control of the goods,

therefore there are special conditions for revenue to be recognised in this

arrangement and all of these should be met.

a. There

should be a very good reason to hold on to the goods (e.g. customer’s request

due to lack of space).

b. The

goods have separately identified as the customer’s property

c. The

product is ready for transfer to the customer

d. The

entity cannot use the product for any other purpose or re-sell to another

customer

4. Consignment – When

an entity delivers a product to its dealers or distributors for sale to end

customers it needs to determine if it’s a sale or a consignment. Below are

indicators of a consignment:

a. The

entity controls the product until it’s sold to the customer or a specified

period expires.

b. The

entity can transfer the product to another party or ask for it to be returned.

c. The

dealer or distributor does not have an unconditional obligation to pay.

Decoding a customer contract

1. Identify the distinct

performance obligations to transfer goods or services or a bundle of goods or services.

2. Identify the transaction

price associated with each distinct performance obligation.

3. Determine if the performance

obligation is satisfied at a point in time or over a period of time.

4. Identify the criteria for

transfer of control to customer

Identifying the drivers:

1. Revenue

and gross margin by customer, by product offerings, by geography and by

distribution channels.

a. Identify

the most profitable customers and those that generate the most revenue for the

company and their concentration.

b. Identify

which goods/services are most profitable; same for geographies and distribution

channels.

c. Identify

customers, goods/services, geography and distribution channels with high

revenue share but low gross margins.

d. Gross

profit tells us the amount of money a company retains after accounting for the

direct costs of production.

e. Therefore,

it is a key metrics in understanding the potential value of a business model

and how sustainable it will be.

f. A high

gross margin could mean the company is operating efficiently while a low gross

margin is evidence that there are areas that need improvement.

g. A low

gross margin could mean:

i. Revenue

may have gone down and/or direct costs may have gone up

ii. Revenue

may have gone up but the cost went up higher

iii. Revenue

have decreased but cost did not decrease in the same proportion

h. One of the common issues witnessed is in regard to recording payroll. Such expenses should be allocated in the proportion they go towards generating revenue. In some cases, it is highly unlikely that 100% of an employees’ time will be spent in activities directly linked to revenue generation (for example a software engineer may divide their time between billable work and R&D). It therefore becomes imperative that such expenses be carefully allocated above and below gross margin.

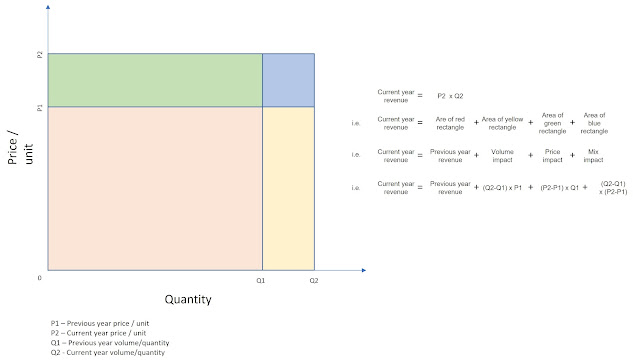

2. Price-volume-mix

analysis – Price volume mix analysis provides a high-level overview of the

past performance and breaks down the changes in revenue or margin into key

components. These components help explain how much of the overall change in

revenue was caused by the price change and the impact from change in volume. It

can also be used to explain the impact of change in total costs, any currency

fluctuation or etc. Below is a simple graphical representation of revenue by

price-volume with price/unit on y-axis and quantity on x-axis. We can do the same

with cost of sales with cost/unit on y-axis and quantity on x-axis.

3. Recurring revenue (if applicable) – Recurring revenue can be defined as regular payments over a period of time as in a subscription business (performance obligation satisfied over time). Recurring revenue are stable and with a higher probability of collection at regular intervals. Annual recurring revenue analysis looks at the increase in revenue from sales to new customers and increase in sales to existing customers, and decrease in revenue from revenue loss from lost/churned customers and decrease in sales to existing customers. It provides a good measure of the quality of revenue generated from a subscription model businesses.

In conclusion the quality of

revenue allows for an accurate determination of the fair value of the entity. A thorough evaluation of quality of revenue will

help determine the viability of the business model, the quality of cash flow –

and their sustainability; and therefore, aids in establishing whether the objectives

of the acquisition can be expected to be met.

More to follow....

Disclaimer:

This is purely an academic pursuit. The views/opinions expressed above are my

own and does not reflect the views of my employer.

Comments

Post a Comment